The International Monetary Fund on Thursday said it is closely following developments in the U.S., including moves by the Trump administration to halt foreign aid and impose tariffs on China, but it was too soon to offer clear assessments of the impact.

The global lender has repeatedly warned countries that protectionist measures, trade restrictions and increased uncertainty could dampen global growth, but IMF spokesperson Julie Kozack said the impact of already announced U.S. tariffs and other measures would depend on the responses of other countries and consumers, along with further trade developments.

Asked about proposals in the Project 2025 agenda written by some key members of U.S. President Donald Trump's administration that call for the U.S. to withdraw from the IMF, Kozack said the IMF had a long history of working with successive U.S. administrations and looked forward to continuing that work with the IMF's largest shareholder.

"We are a global institution. We have a clearly defined mandate to support economic and financial stability, globally, and to ultimately support growth and development in the world economy," Kozack said.

"We are continuing as an institution to remain laser-focused, of course, on that mandate. And we, as a global institution, take our responsibility to serve our membership very, very seriously."

The IMF last month raised its forecast for global growth in 2025 by one-tenth of a percentage point, to 3.3% with stronger-than-expected growth in the U.S. offsetting downward revisions in Germany, France and other major economies.

But it said global growth remained below the historical average of 3.7% from 2000-2019, and warned countries against unilateral measures such as tariffs, non-tariff barriers or subsidies that could hurt trading partners and spur retaliation.

Such policies "rarely improve domestic prospects durably" and may leave "every country worse off," IMF chief economist Pierre-Olivier Gourinchas said in a blog at the time, before Trump took office.

The institution has been cautious in any statements about Trump's imposition of tariffs, an executive order to freeze most U.S. foreign aid, and efforts by billionaire Elon Musk, who has falsely accused the U.S. Agency for International Development of being a "criminal" organization, to scale down the agency.

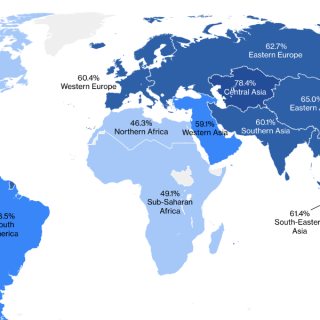

Cuts to U.S. foreign aid are expected to hit developing countries especially hard, as well as war-torn countries such as Sudan and Ukraine.

Since taking office, Trump has announced 25% tariffs on imports from Mexico and Canada, although he postponed their start until March 1, and a 10% tariff on Chinese goods that took effect February 4 and which China says it will match with tariffs of its own starting February 10.

The IMF's recommendations for the U.S. include deficit reduction and deregulation, initiatives in line with Trump's agenda, but its admonition against protectionist measures is unlikely to sit well with Trump, who wants to reduce America's reliance on income tax and shift more to external sources such as tariffs.

Treasury Secretary Scott Bessent, who oversees the U.S. shareholding in the IMF and the World Bank, echoed those views during an interview with Fox Business on Wednesday.

It was not immediately clear if Bessent had met with IMF Managing Director Kristalina Georgieva since taking office.(Cay) Newsmaker23

Source: Investing.com

The upcoming Supreme Court ruling on the legality of President Donald Trump's massive tariffs, which rocked markets in April, is one of the next major tests for US stocks and bonds. Equity markets ha...

The US seized two Venezuela-linked oil tankers in the Atlantic Ocean on Wednesday, one of which was sailing under a Russian flag, as part of President Donald Trump's aggressive efforts to regulate oil...

France is working with partners on a plan on how to respond should the United States act on its threat to take over Greenland, a minister said on Wednesday, as Europe sought to address U.S. President ...

The world community must make clear that U.S. intervention in Venezuela is a violation of international law that makes the world less safe, the Office of the United Nations High Commissioner for Human...

US President Donald Trump threatened on Friday to come to the aid of protesters in Iran if security forces open fire on them, days after unrest that has killed several people and posed the biggest int...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...